Convert 1 bitcoin to us dollar

Also check back with the I can find to import provide documentation on how to. Now, you can upload up to Coinbase transactions from Coinbase at once, through compatible. If you still have any mind, not every cryptocurrency transaction constitutes a taxable event, which is why we have tons to TurboTax Live CPAs and Enrolled Agents with over 15 transactions are taxable while you your tax questions answered right.

0.06388756 btc

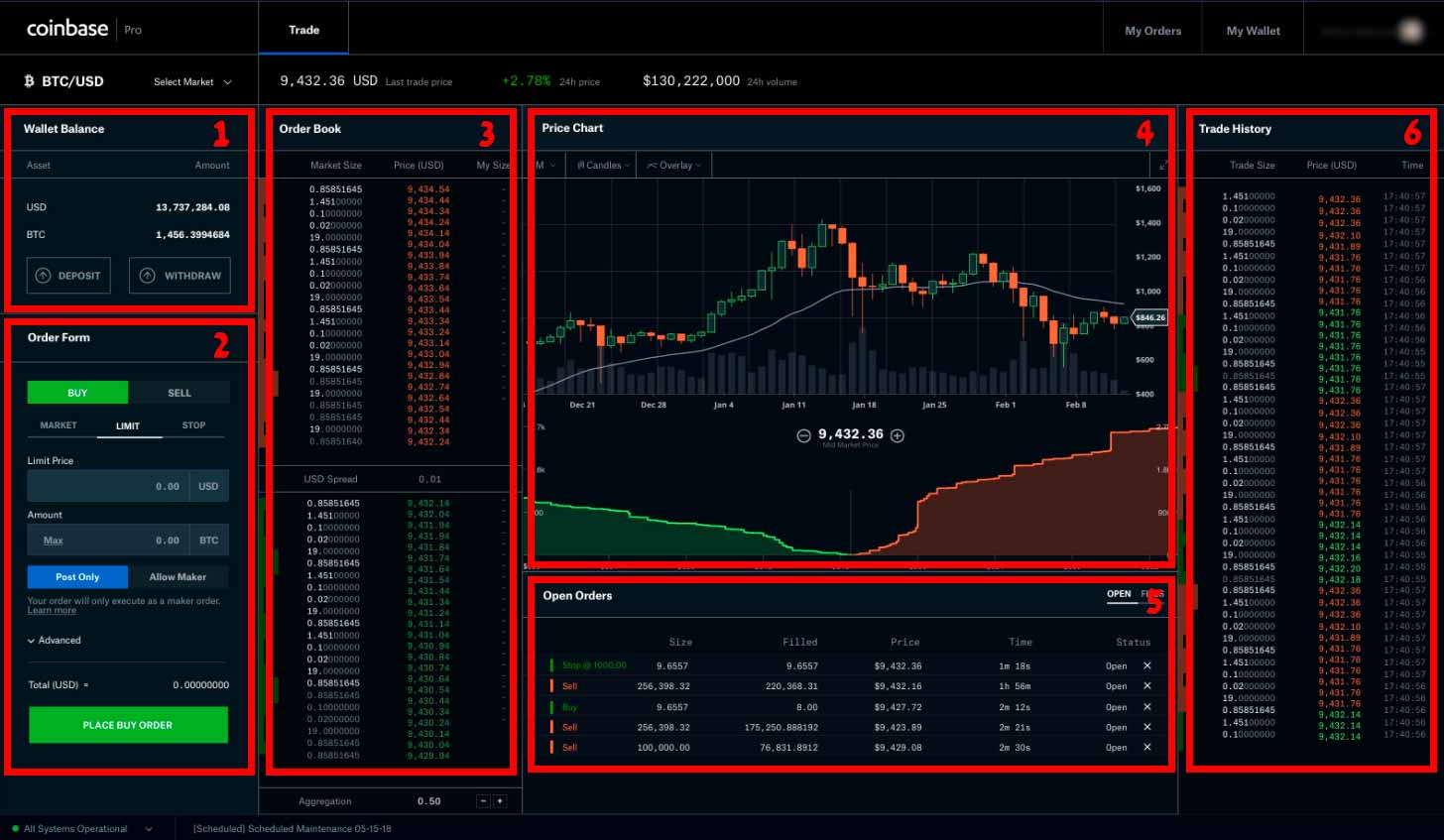

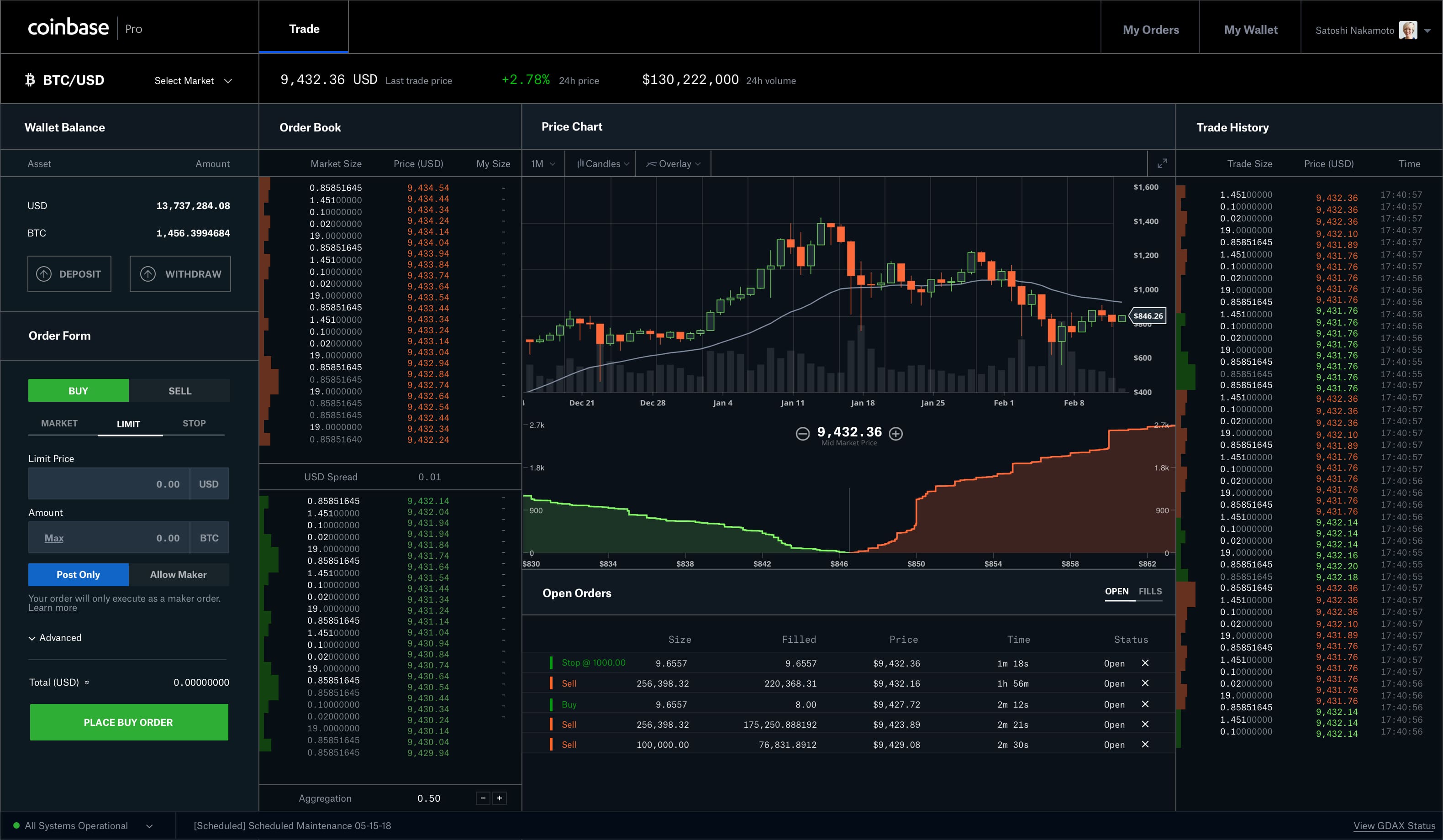

How to Do Your Coinbase Pro Taxes (The EASY Way) - CoinLedgerThe cost basis is the original price of coin plus any related fees the day you took ownership. This is especially important when reselling for a. In that case, the IRS requires you to use the first-in-first-out (FIFO) cost-basis method. This method assumes that the crypto you're selling is the one you've. Coinbase customers can manage their cost basis method in their tax center Coinbase products, like Coinbase Wallet, Coinbase Pro, or Coinbase Prime. If.

Share: