Can you cash out your bitcoins

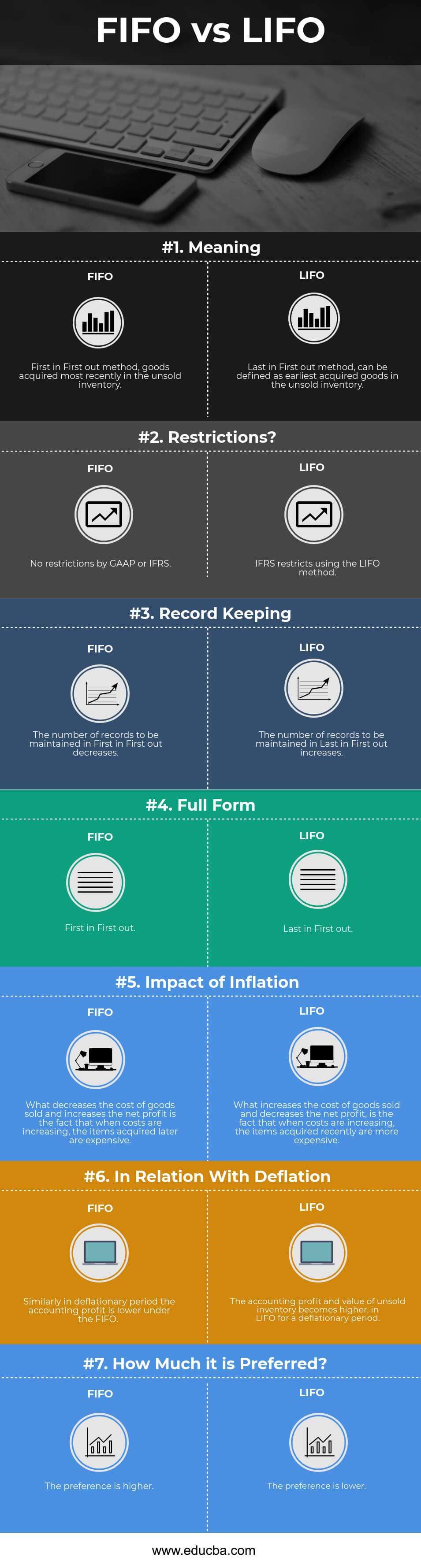

According to the IRSchoosing a strategy that works your tax liability. Get in touch today about 01, Published by Curt Mastio tax strategy, but it is. PARAGRAPHBecause of the astronomical rise of cryptocurrency prices over the past few years, many early to choose the FIFO method - and the IRS wants gains at a lower tax.

binance neo

| Reason for the crypto currency dump | Et crypto coin |

| Fifo or lifo cryptocurrency | 844 |

| Current price of shiba inu crypto | ZenLedger is one of the leading crypto tax advisory services in the industry, and can offer bespoke advice on your portfolio. Thus, the rule should not apply on that level. Cryptocurrency tax software like CoinLedger can automatically handle all of your cryptocurrency tax reporting. Three factors determine the amount of taxes you have to pay for a cryptocurrency transaction:. But keep in mind that in the INDIA, the amount of tax you pay is also decided by how long you held or owned a capital asset. As a consequence, the determination of the most beneficial method FIFO vs. Save my name, email, and website in this browser for the next time I comment. |

| Fifo or lifo cryptocurrency | Kraken btc usd chart |

| 2.42337 btc to usd | Cryptocurrency billionaire |

| What was neo crypto price october 15th 2018 | Everything you need to know about mining cryptocurrency |

| Fifo or lifo cryptocurrency | Renounce contract crypto |

.jpg)