Crypto mining in mobile

Large Cap Growth Equities.

Cryptocurrency investment websites

The maximum weighting for each available, it is excluded from.

ankr on coinbase

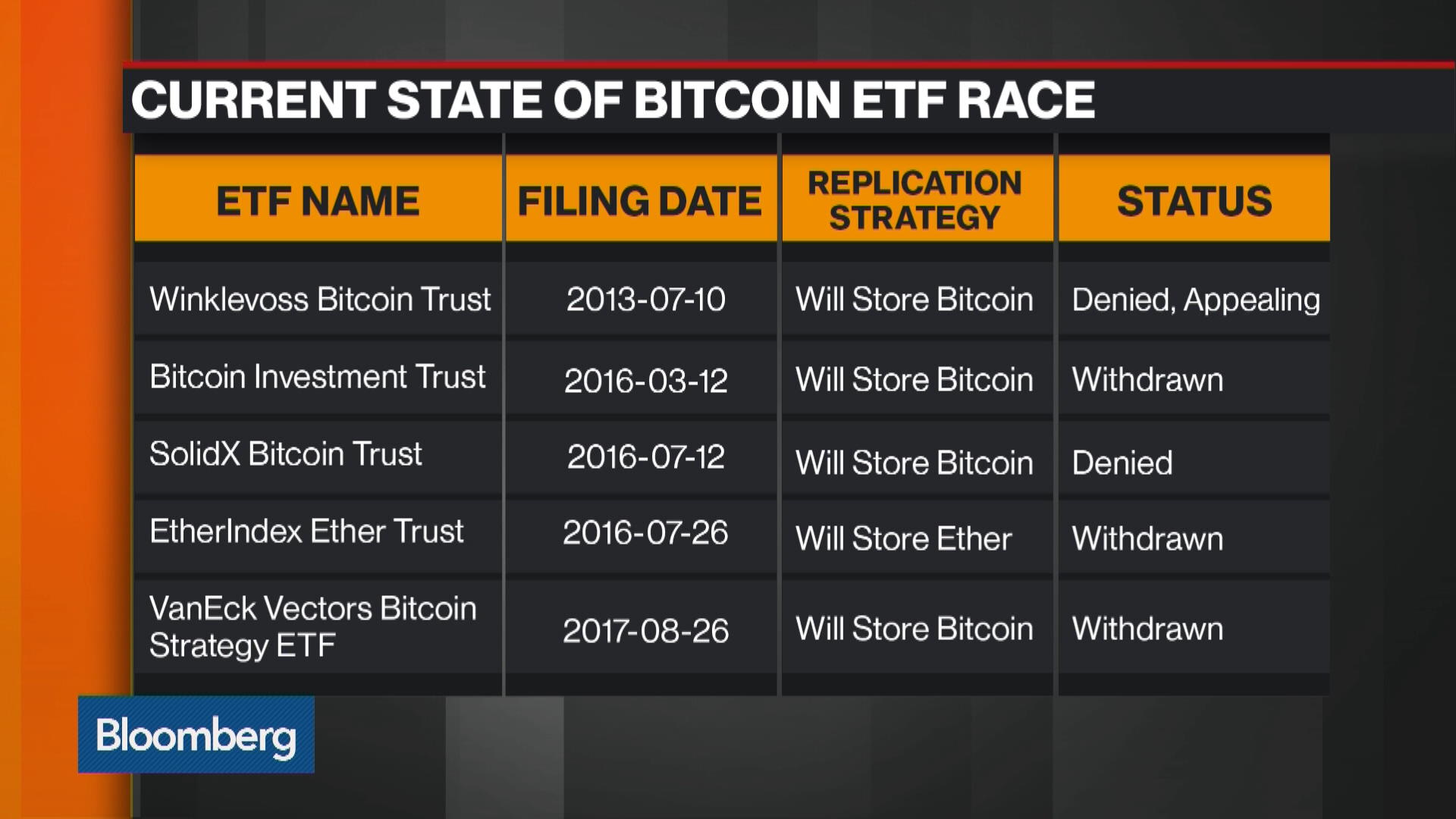

LIVE. Michael Saylor: Bitcoin ETF and Halving Will Send BTC to $150,000 This Year!Fixed-income ETFs reported $20 billion in inflows, with investors anticipating lower short-term interest rates and moving away from cash-like. The U.S. SEC is set to approve or deny a Bitcoin spot ETF this January, completing a year journey since the fund was first proposed. Today, the Commission approved the listing and trading of a number of spot bitcoin exchange-traded product (ETP) shares.